What is Mobile Money?

What is Mobile Money?

Mobile Money is a form of digital money, where instead of a bank account and a card, people get a mobile money wallet connected to their phone number.

When people sign up for a mobile money account with their Mobile Money Operator (MMO), they undergo a ‘Know Your Customer’ (KYC) process, similar to opening a bank account.

nstead of ATMs and bank branches, you can put money on your mobile money wallet through an extensive agent network. Instead of getting a bank account number/IBAN, your mobile money wallet is identified by your phone number.

Mobile money is a convenient way to send and receive money, pay bills, and make purchases using your mobile phone.

Mobile money wallets have transaction limits like many modern bank accounts and cards. Most important limits are:

- Number of payments done within a day, week, or month.

- Value of payments done within a day, week, or month.

- Maximum balance of a mobile money wallet.

Users can have those limits raised by going through extended KYC processes with the MMOs.

How does it work?

Mobile money payments are different from classic card payments. They are more similar to A2A or 3-D Secure enabled card payments. Specifically, the user has to explicitly authorise each payment.

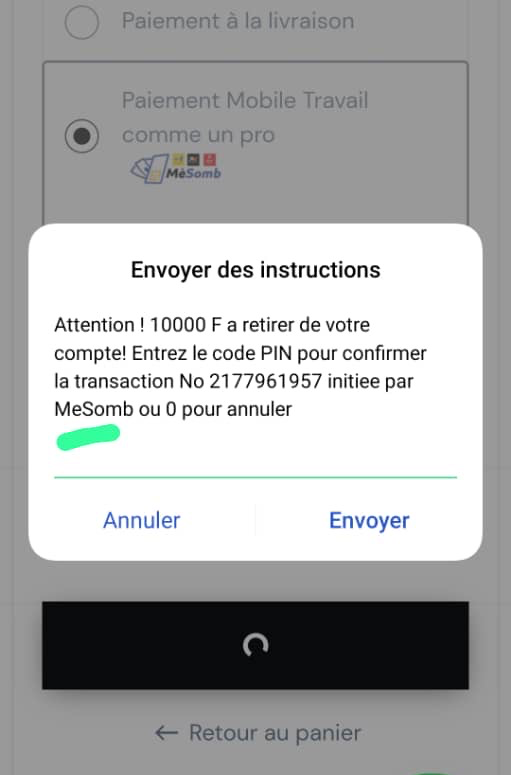

With most providers, each payment requires the user to enter their PIN code on their phone. This is similar to entering a PIN code on a card reader when paying with a card. Depending on the provider, it can be 4 or 6 digits long.

When a user makes a payment, they receive a notification on their phone, prompting them to confirm the transaction by entering their PIN code. This adds an extra layer of security to the payment process.

This is the main use case when telcom is working fine you will receive a notification on your phone, prompting you to confirm the transaction by entering your PIN code.

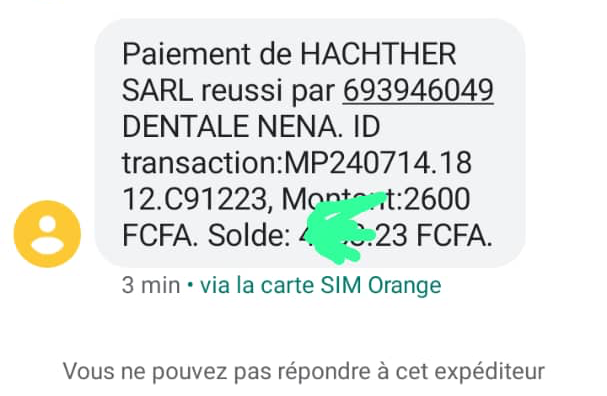

But sometimes, the telecom network is not working properly to receive push notification on the phone, then you will not receive a notification on your phone but an SMS to confirm.

Once the payment is confirmed, the user receives a confirmation message, and the payment is processed.

This makes mobile money payments much more secure than classic card payments, reducing fraud and chargeback risk to a minimum.

This has two important implications.

First, this expands the technical infrastructure involved in processing every single payment. Since the user needs to enter their mobile money PIN code to authorize each payment, both the server infrastructure and the cell network infrastructure are involved in the payment chain. The PIN code is usually requested from the user by sending a USSD message over the cell network and utilising the handset’s SIM toolkit to handle user interaction. This gives mobile money incredible accessibility as it works securely on everything from the simplest of push-button handsets all the way to flagship smartphones. On the flip side, there’s a lot involved from server infrastructure, internet connectivity, cell networks, USSD gateways, etc.

Second, the user is now part of the processing chain of each transaction. A user attempting to initiate a payment on your website or app needs to take out their handset and enter their PIN in a limited amount of time. Or they might not find their phone, accidentally close the PIN prompt, forget their PIN code, get a phone call, etc.

To conclude, mobile money is highly accessible and secure. The challenges to ensure high success rates and a great customer experience are different from other payment methods. With the MeSomb Merchant API, you have the means to make sure the customer has the best experience possible.

With the MeSomb Merchant API you can easily transact with your customers in any way you need:

- You can collect money from them: Funds will move from the customer’s mobile money wallet into your account in MeSomb. You can do that by following our guide for Collect or the Payment.

- You can disburse money to them: Funds will move from your account in MeSomb to the customer’s mobile money wallet. You can do that by following our guide for Deposits.

- You can refund them: Already collected funds will move back from your account in MeSomb to the customer’s mobile money wallet. You can do that following our guide for Refunds.